interest rates: banking institutions

Open Banking will give you the choice to share your AMP Bank data with accredited data recipients. Check out AMP Bank Everyday and savings bank accounts interest rates fees here.

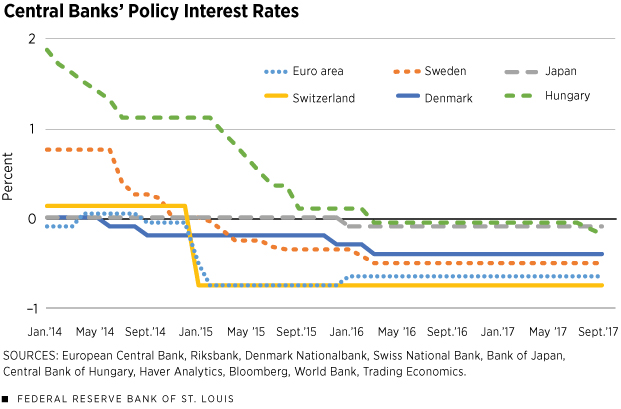

Some Positives In Negative Interest Rates St Louis Fed

Bringing short-term interest rates down.

. On the investing side financial institutions generally use APY to describe the interest rate. The second is investor demand for US. Must contain at least 4 different symbols.

Certificates of deposit rate. Or the rate that institutions charge each. The first attempt to control interest rates through manipulation of the money supply was made by the Banque de France in 1847.

Treasury notes and bonds. There are no minimum balance requirements to keep or open the account with free ATMs at over 39000 Capital One or Allpoint locations at no cost. 12 CFR 74001 Charging interest by national banks at rates permitted competing institutions.

The Basel Committee on Banking Supervision has today issued standards for Interest Rate Risk in the Banking Book IRRBB. The positive level of inflation and interest rates also provides the central bank with the flexibility to lower rates in response to an economic slowdown. AMP 6-month Notice Account Financial financial institutions only 180 days.

Alliant Credit Union gives you more for your money with online banking award-winning savings and checking accounts credit cards and loans. Charging interest to corporate borrowers. That affects short-term and variable interest rates.

But in March 2022 the Fed raised interest rates for the first time since December 2018 and then raised rates again in May 2022 and June 2022. CD interest rates have changed over time typically following movements in the federal funds rate. A compilation of laws regulations cases and web sources on credit banking and interest rate law.

A compilation of laws regulations cases and web sources on credit banking and interest rate law. The standards revise the Committees 2004 Principles for the management and supervision of interest rate risk which set out supervisory expectations for banks identification measurement monitoring and control of IRRBB as well. Banking overview Compare Accounts.

The latter half of the 20th century saw the rise of interest-free Islamic banking and finance a movement that applies Islamic law to financial institutions and the economy. Prime brokerage with hedge funds has been an especially profitable business as well as risky as seen in the bank run with Bear Stearns in 2008. Banks generally use APR to describe interest rates for loans or credit cards but since APR doesnt highlight the effects of compounding consumers actual borrowing costs may be higher than expected.

The federal funds rate for example is the interest rate that depository institutions such as banks charge one another for borrowing money and its a common benchmark for certificate of deposit interest rates. Capital One Checking Account Interest Rates. Global transaction banking is the division that provides cash management securities services including custody and securities lending etc to institutions.

It was only after the Treasury-Federal Reserve Accord of 1951 that the federal funds market emerged as the main market for US. Pay off high-interest debt or have access to emergency funds when you need it with an Alliant Home Equity Line of Credit. The vast majority of institutions are well capitalized with total risk-based capital in excess of 10 a critically undercapitalized bank is.

The 1980s is largely viewed as a heyday for CDs with interest rates hovering near or above 10. But prevailing interest rates are always changing and different types of loans offer different interest rates. Some countries including Iran.

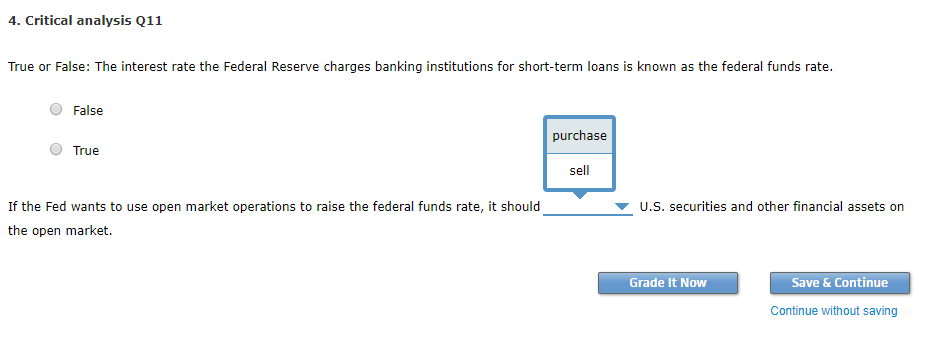

The federal funds rate is the interest rate that depository institutionsbanks savings and loans and credit unionscharge each other for overnight loans whereas the discount rate is the. Interest rate is the amount charged expressed as a percentage of principal by a lender to a borrower for the use of assets. 6 to 30 characters long.

ASCII characters only characters found on a standard US keyboard. Interest rate type Interest rate pa Applying as of See graph. Interest rates are typically noted on an annual basis known as the.

It offers loans and mortgages and can change interest rates depending on business needs. As of July 2021 high-interest savings accounts averaged around 040 APY 1 which is considerably higher than the FDICs published national average rate for savings accounts of 006. The third force is the banking industry.

The Depression kept interest rates low in the 1930s and during the war years of the 1940s interest rates were pegged. Banks to lend and borrow money from each other. Banking Credit Cards.

The top rate you can currently earn from a nationally available savings account is 350 annual percentage yield APY offered by Fitness BankThats almost 18 times the FDICs national average. CD issuers may base their rates on other benchmark interest rates. Interest can also refer to the amount of ownership a stockholder has in a company.

Capital Ones 360 Checking account is a fee-free online and mobile account. The expected rise in interest rates will help generate higher returns on bank assets and contribute to growth. High-interest savings accounts are usually opened and accessed online but brick-and-mortar financial institutions may offer these types of accounts as well.

Interest is the charge for the privilege of borrowing money typically expressed as annual percentage rate. In August 2020 the Federal Reserve. Current benchmark interest rates.

Top-yielding banks have raised savings rates in. That affects long-term and fixed interest rates. Rising interest rates could force some community banks to fall below a critical capital threshold that the Federal Housing Finance Agency uses to determine eligibility for Home Loan bank advances.

An Alliant car loan or refi puts you in the. The value of gross loans and leases is projected to rise 58 per year to 2026.

Mckinsey S Global Banking Annual Review Mckinsey

The Evolution Of Foreign Banking Institutions In The United States Developments In International Finance African Studies 129 9780899303710 Economics Books Amazon Com

The Upside Down Banks Deposits And Negative Rates

Bank Of America Savings And Cd Rates How They Compare With Better Options Nextadvisor With Time

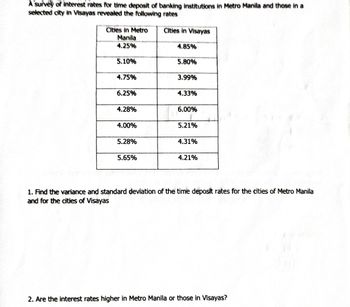

Answered A Survey Of Interest Rates For Time Bartleby

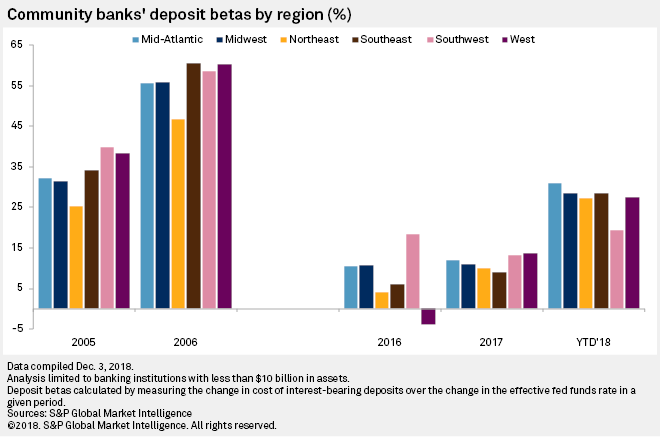

Deposit Betas Eating Into Us Community Bank Profits Some Regions Stand Out S P Global Market Intelligence

:max_bytes(150000):strip_icc()/how-your-credit-score-influences-your-interest-rate-960278_fin2-6e9a6586481946a4a418afa6d7e2522e.png)

How A Credit Score Influences Your Interest Rate

The World S Highest Interest Rates At Offshore Banks 2022

Primebank Le Mars Sioux Center Sioux City Banks Bank Financial Institutions Financial Services Banking Checking Accounts Free Rewards Interest Interest Rates Deposit Rates Cash Back Points Loans Mortgage Home Loans Home Financing

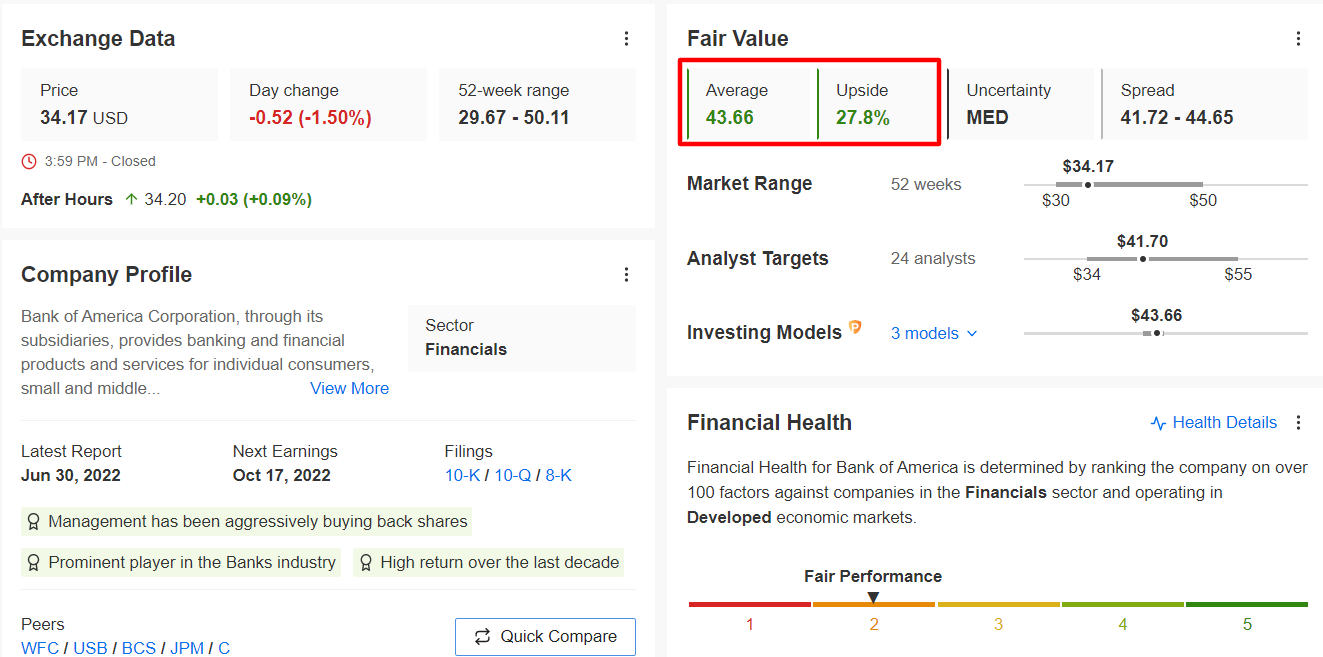

3 Leading Stocks Best Suited For Rising Interest Rates Hawkish Fed Dragoninkhouse

Solved 4 Critical Analysis Q11 True Or False The Interest Chegg Com

An Analysis Of Financial Institutions In Black Majority Communities Black Borrowers And Depositors Face Considerable Challenges In Accessing Banking Services

Why Do Central Banks Raise Interest Rates To Curb Inflation Euronews

Some Us Regions Get Hit Harder As Community Banks Pay Up For Deposits S P Global Market Intelligence

When Will Savings Account Interest Rates Rise Nextadvisor With Time

3 Leading Stocks Best Suited For Rising Interest Rates Hawkish Fed Dragoninkhouse

10 Best Cd Rates Of October 2022 Money

:max_bytes(150000):strip_icc():format(webp)/TermDefinitions_LIBOR_finalv1-31600ab5e7104ece9d2afa47e6a8064f.png)

:max_bytes(150000):strip_icc()/how-to-choose-a-bank-5183999_V3-377dc97d93214537854b8291c3dcafaa.png)

0 Response to "interest rates: banking institutions"

Post a Comment